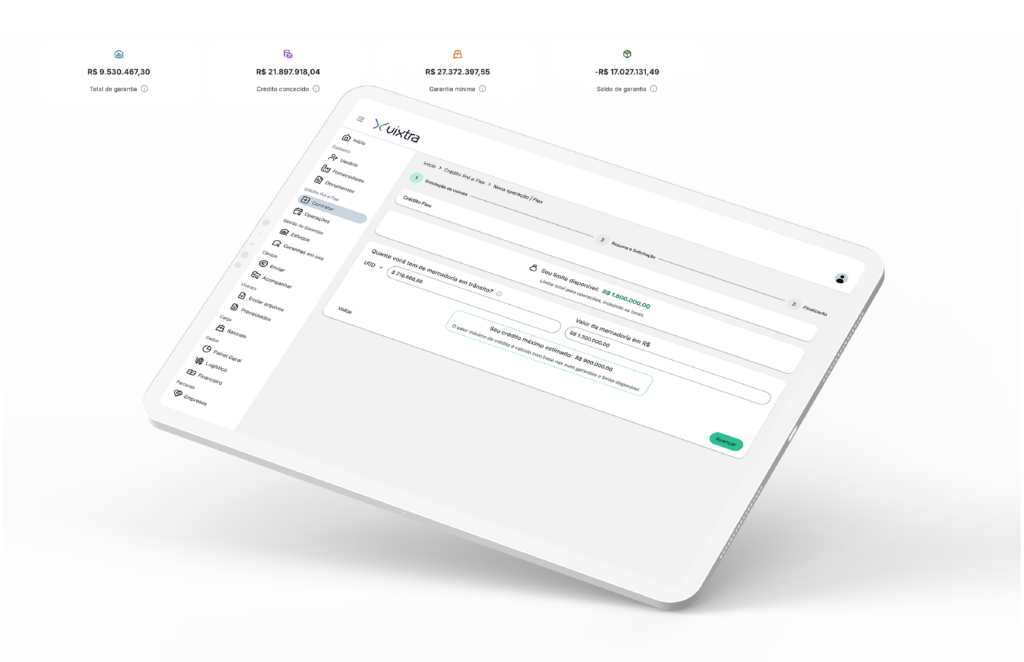

CREDIT FLEX

Boost Your Working Capital Now

Unlock exclusive financing tailored for importers. Use your in-transit cargo as collateral—no need to tie up receivables or existing credit lines. Funds are available in local currency, ready to use however you need.

"Our operation is like a bank offering working capital, but instead of you exchanging invoices, you exchange the stock in transit."

WHY IMPORTERS CHOOSE FLEX CREDIT

Maximum Flexibility

Use financing to pay suppliers, fund operations, or invest in business growth.

Preserve Your Credit Lines

No impact on receivables, traditional guarantees, or existing credit facilities.

Lower Financial Risk

Your cargo in transit replaces the need for fixed-asset collateral.

Act Fast on Opportunities

Get immediate funding to secure discounts and negotiate better deals.

Stay Competitive

Improve supplier terms, optimize logistics, and scale your business with confidence.

BEYOND IMPORT FINANCING

A Smarter Way to Fund Growth

Vixtra’s Flex Credit is more than just an import solution—it’s a game changer for cash flow management and strategic expansion.

Scale Without Limits

Scale Without Limits

Expand operations without tying up working capital.

Leverage Supplier Negotiation

Leverage Supplier Negotiation

Strengthen your purchasing power with better terms and supply chain flexibility.

Reduce Risk Exposure

Reduce Risk Exposure

Collateral is based on your in-transit goods, eliminating the need for traditional asset-backed guarantees.

Seize Market Opportunities

Seize Market Opportunities

Take advantage of bulk discounts, secure lower prices on materials, and increase purchasing capacity.

Expand with Confidence

Expand with Confidence

Grow into new markets, import higher volumes, and keep cash flow healthy.

Industries attended

SUCCESS STORIES

Our customers’ success speaks for itself. See how importers are transforming their business with Flex Credit.

- Japurá Pneus

R$83

Millions in Imports

Vixtra Products

![]()

![]()

What Makes Flex Credit Different?

Designed specifically for importers, Flex Credit offers a streamlined financing solution that helps businesses stay liquid and competitive.

Fast & Flexible Funding

Fast & Flexible Funding

Finance up to 80% of your import value.

Get funds released within 72 hours after guarantee approval.

Simple Collateral Process

Simple Collateral Process

Use in-transit cargo as collateral (Bill of Lading – BL).

No need for receivables, financial applications, or real estate guarantees.

No Bank Debt

No Bank Debt

This financing does not count as bank debt.

It won’t affect your existing credit lines or appear in banking reports.

100% Local Currency

100% Local Currency

No foreign exchange exposure or currency volatility.

Predictable cash flow without hedging costs.

Ongoing Credit Renewal

Ongoing Credit Renewal

Collateral updates automatically as new shipments depart.

Maintain an active credit line without repeated approvals.

Flexible Repayment Terms

Flexible Repayment Terms

Standard repayment up to 150 days.

Extended terms available up to 270 days, depending on operation and financial regulations.

“Japurá Pneus faced challenges with traditional financing, marked by heavy requirements and slow credit approval — a critical issue for import operations. Vixtra changed this scenario: the credit was released in just 24 hours, allowing the company to maintain healthy cash flow and ensure inventory replenishment. It was a game changer. We kept capital circulating without tying up cash, gaining the financial freedom to grow and expand.”

“Vixtra has been a great financial partner in the foreign trade market, providing funding and agility in the execution of international operations. This partnership has already enabled several deals and will continue to open new opportunities. Vixtra facilitates our communication with international suppliers and accelerates the introduction of new products and technologies into our portfolio, directly contributing to the development of our industrial complex and to innovation in the healthcare sector. We are very satisfied with this collaboration.”

“Vixtra has become an essential partner in the import of inputs for our production line, offering a unique solution in the market that is fully aligned with our needs. The platform allows us to map and manage all imports in an intelligent way, including processes outside Vixtra, bringing operational efficiency and clarity. The import expertise combined with the financial service is a major differentiator. We are very satisfied with this partnership.”

How Importers Are Using Flex Credit

Hundreds of importers across industries are leveraging Vixtra’s Flex Credit to scale operations, reduce costs, and improve liquidity. Here’s how they’re benefiting:

Stronger Working Capital

Stronger Working Capital

83% increased their financial capacity to scale operations, reduce supplier dependency, and negotiate better payment terms.

Better Cash Flow Management

Better Cash Flow Management

52% accessed immediate funds to cover seasonal expenses and manage cash flow fluctuations.

Market Expansion

Market Expansion

23% used financing to enter new regional markets, increasing reach and customer base.

Shifting from Air to Ocean Freight

Shifting from Air to Ocean Freight

16% transitioned from expensive air freight to cost-efficient maritime shipping, boosting profit margins.

Lower Operational Costs

Lower Operational Costs

41% cut expenses by optimizing supplier negotiations and cost structures.

Early Payment Benefits

Early Payment Benefits

15% secured better pricing by prepaying for raw materials and inventory.

Increased Purchasing & Sales

Increased Purchasing & Sales

28% expanded buying power to stock more inventory and increase production capacity.

Crisis-Ready Financial Stability

Crisis-Ready Financial Stability

10% secured additional liquidity to navigate market downturns and seasonal lows.

Let’s Get Started

Tell us a little about yourself, your company, and your import operations. It’s the fastest and most efficient way to start your journey with Vixtra.

Our support is 100% human. Help us by filling in your details accurately, and one of our specialists will be in touch soon.

Want to talk now?

- 11 93620 8185

- [email protected]